“You learn in this business: If you want a friend, get a dog.”

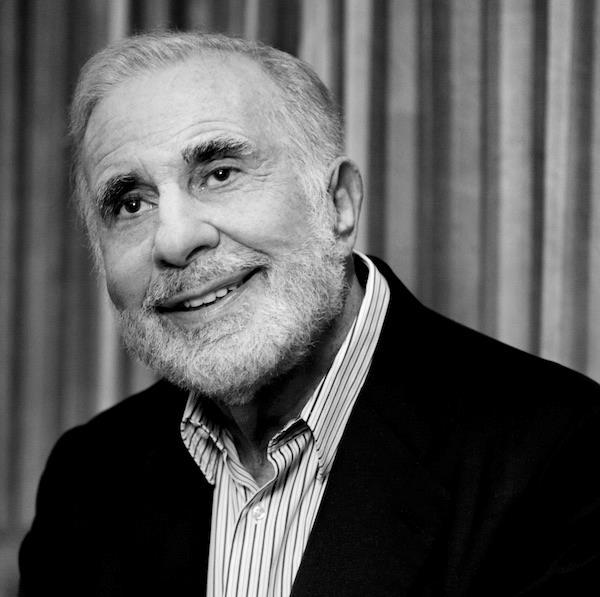

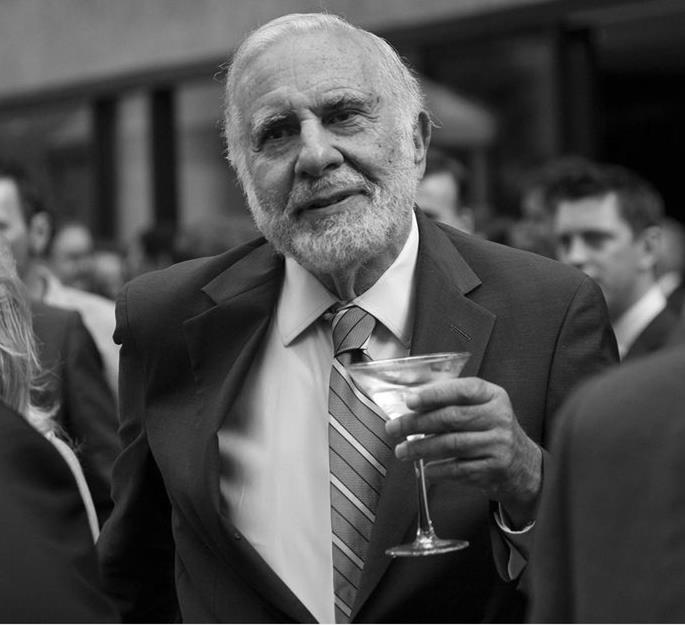

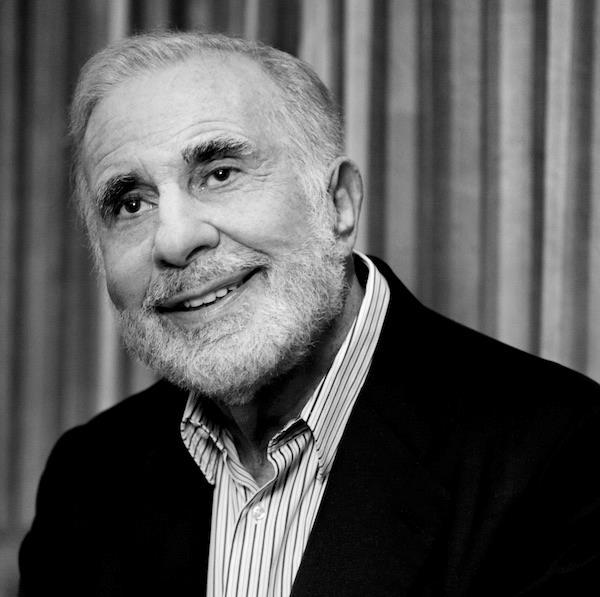

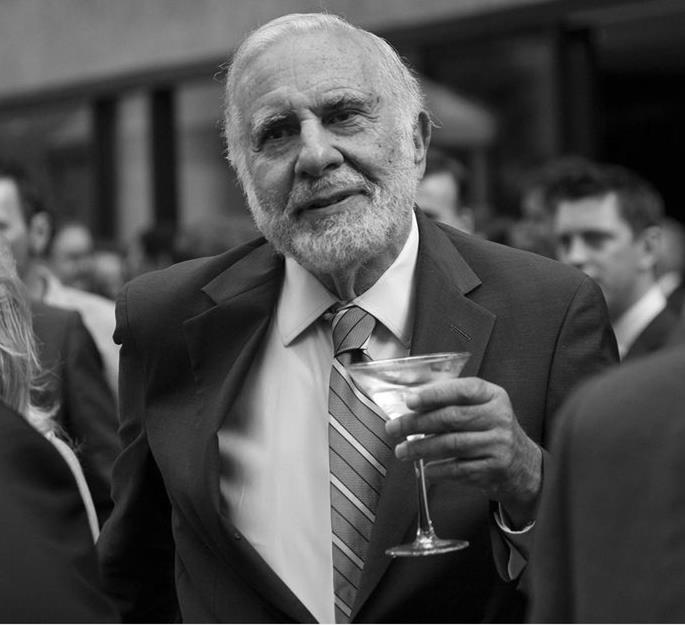

Carl Icahn is an incredibly successful American

investor, entrepreneur, and philanthropist. Throughout his long and illustrious

career, he has left an indelible mark on the world of finance and business.

Known for his sharp investment strategies and bold activism, Icahn has earned a

reputation as one of the most influential figures in the industry. With a keen

eye for opportunities, Icahn has built a remarkable track record of making

savvy investment decisions. He has fearlessly taken on corporate giants,

acquiring substantial stakes in companies, and using his influence to push for

changes that benefit shareholders. These battles have garnered widespread

attention and admiration.

Beyond his investment prowess, Icahn has shown a deep

commitment to giving back. Through his philanthropic efforts, he has made

significant contributions to education, healthcare, and medical research. His

generosity has positively impacted the lives of many.

In the upcoming sections, we will explore the fascinating

life and achievements of Carl Icahn.

Early Life and Education:

Carl Icahn was born on February 16, 1936, in a middle-class

neighborhood in New York City. From a young age, he displayed a natural

curiosity and a sharp intellect, traits that would shape his future success in

the business world. Growing up, Icahn developed a strong work ethic, taking on

odd jobs to earn extra money. These experiences taught him the value of hard

work and perseverance, which would later become pillars of his professional

journey.

Icahn's academic journey led him to study philosophy at

Princeton University and graduated in 1957. While his chosen field might seem

unconventional for a future finance mogul, his studies cultivated critical

thinking skills and a deep understanding of human behavior. These insights

would prove invaluable as he navigated the complex world of investing.

After graduating from Princeton, Icahn pursued a medical

degree at the New York University School of Medicine. However, he soon realized

that his true passion lay elsewhere. Driven by his innate entrepreneurial

spirit, Icahn decided to redirect his career path towards the world of finance.

The decision to venture into finance marked a turning point

in Icahn's life. It was a decision that would eventually lead him to become one

of the most successful and influential investors of his time.

Professional Journey:

After graduating from Princeton University with a degree in

philosophy in 1957, Icahn began his career as a stockbroker for Dreyfus

Corporation. He then worked as an options manager for Tessel, Patrick and

Company and Gruntal& Co.

In 1968, Icahn founded Icahn & Company, a hedge fund that

specialized in risk arbitrage and options trading. He quickly made a name for

himself as a corporate raider, taking large stakes in companies and then

pressuring management to make changes that he believed would benefit

shareholders. Some of his most notable targets in the 1970s and 1980s included

TWA, Phillips Petroleum, and RJR Nabisco.

In the 1990s, Icahn began to focus on activist investing,

which involves taking large stakes in companies and then using his influence to

push for changes in corporate governance or strategy. He has been successful in

this approach, forcing companies to make changes such as increasing dividends,

buying back stock, or selling off assets.

Icahn is currently the chairman and CEO of Icahn Enterprises,

a diversified conglomerate holding company with interests in a wide range of

industries, including manufacturing, energy, transportation, and financial

services. He is also a major shareholder in several public companies, including

Apple, Netflix, and eBay.

Here are some additional details about some of Icahn's most

notable investments:

TWA: In 1985, Icahn acquired a controlling stake in TWA, the struggling

airline. He then forced the company to file for bankruptcy, which allowed him

to sell off assets and restructure the company's debt. However, TWA eventually

went out of business in 2001.

Phillips Petroleum: In 1986, Icahn acquired a 20% stake in Phillips Petroleum,

the oil and gas company. He then launched a proxy fight to replace the

company's board of directors. Icahn was successful in his campaign, and he

eventually became chairman of the board.

RJR Nabisco: In 1988, Icahn teamed up with Kohlberg Kravis Roberts &

Co. to make a hostile takeover bid for RJR Nabisco, the food and tobacco

company. The bidding war that ensued became the largest corporate takeover in

history at the time. Ultimately, KKR won the bidding war, but Icahn made a

significant profit from the deal.

American Railcar Industries: In 2005, Icahn acquired American

Railcar Industries, a manufacturer of railcars. He then launched a turnaround

effort that resulted in the company's stock price more than doubling.

Time Warner: In 2009, Icahn led a successful campaign to break up Time

Warner, the media conglomerate. He argued that the company was too large and

unwieldy, and that it would be better off as two separate companies. Time

Warner eventually agreed to split into two companies, Time Warner Cable, and

Warner Bros.

Herbalife: In 2012, Icahn acquired a 13% stake in Herbalife, the

dietary supplement company. He then launched a campaign to shorten the

company's stock, betting that its shares would decline in value. Herbalife's

stock price has been volatile in recent years, but it has generally trended

upwards.

Philosophy and Approach:

Carl Icahn is known for his aggressive investment philosophy,

which is often summarized as "buy something when no one else wants

it." He is a contrarian investor, which means that he looks for stocks

that are undervalued or out of favor with the market. He believes that these

stocks are often mispriced, and that he can profit by buying them and holding

them for the long term.

Icahn is also known for his activist investing approach. This

means that he does not simply buy shares in a company and then sits back and waits

for the stock price to go up. Instead, he actively engages with management and

pushes for changes that he believes will improve the company's value. This can

include things like increasing dividends, buying back stock, or selling off

assets.

Icahn's investment philosophy has been successful over the

years. He has made billions of dollars for himself and his shareholders, and he

has been ranked as one of the richest people in the world. However, his

approach has also been controversial. Some critics argue that he is too

aggressive and that he often destabilizes companies with his activism. Others

argue that he is a corporate raider who only cares about making money, not

about improving the companies he invests in.

Despite the controversy, Icahn remains one of the most

successful investors in the world. His investment philosophy is based on a few

key principles:

Buy undervalued stocks: Icahn looks for stocks that are trading below their

intrinsic value. He believes that these stocks are often mispriced, and that he

can profit by buying them and holding them for the long term.

Be a contrarian investor: Icahn is not afraid to go against the crowd. He often

buys stocks that are out of favor with the market, believing that they are

undervalued.

Be an activist investor: Icahn does not simply buy shares in a company and

then sit back and wait for the stock price to go up. Instead, he actively

engages with management and pushes for changes that he believes will improve

the company's value.

Icahn Philanthropic:

Carl Icahn is a philanthropist who has donated millions of

dollars to various causes, including medicine, education, and child welfare.

Here are some of his most notable philanthropic contributions:

Mount Sinai School of Medicine: Icahn has donated over $200 million

to Mount Sinai School of Medicine, which has been renamed the Icahn School of

Medicine at Mount Sinai in his honor. His donations have helped to fund research,

scholarships, and new buildings at the school.

Children's Rescue Fund: Icahn founded the Children's Rescue Fund in 1985 to

provide temporary housing and other services to homeless families in New York

City. The fund has helped to provide housing for over 10,000 families and has

also provided educational and job training programs.

Icahn Charter Schools: Icahn has founded six charter schools in New York City that

provide a rigorous academic program to students from low-income families. The

schools have consistently outperformed traditional public schools on

standardized tests.

Randall's Island Sports Foundation: Icahn has donated over $10 million

to the Randall's Island Sports Foundation, which supports the development of

athletic facilities and programs on Randall's Island in New York City. The

foundation has built several new sports facilities on the island, including

Icahn Stadium, a track and field stadium.

Princeton University: Icahn has donated over $100 million to Princeton University,

his alma mater. His donations have helped to fund research, scholarships, and

new buildings on campus.

Icahn is a generous philanthropist who has made a significant

impact on several important causes. His donations have helped to improve the

lives of millions of people around the world.

In addition to these specific contributions, Icahn has also

pledged to give away more than half of his wealth to charity. He is a member of

The Giving Pledge, a commitment by some of the world's wealthiest people to

donate most of their wealth to charitable causes.

Icahn's philanthropy is motivated by his belief that everyone

deserves a chance to succeed. He has said that he wants to "make a

difference in the world" and that he believes "philanthropy is the

best way to do that."

Personal life:

Carl Icahn is a private person who does not often share

details about his personal life. However, what is known about his personal life

paints a picture of a complex and interesting individual.

Icahn is the only child of Michael Icahn, a cantor, and Bella

Schnall, a schoolteacher. Icahn graduated from Princeton University with a

degree in philosophy in 1957. In 1979, Icahn married LibaTrejbal. They had two

children together, Brett and Michelle. Icahn and Trejbal divorced in 1999. In

2000, Icahn married his longtime assistant, Gail Golden. Icahn is a passionate

art collector and owns several works by famous artists, including Pablo Picasso

and Andy Warhol. He is also a lifelong Mets fan and has owned a minority stake

in the team since 1982. Icahn is a controversial figure who has been criticized

for his aggressive investment style and his willingness to take on large

companies.

Icahn's legal battles:

Texaco Inc. (1985): In one of his most famous legal battles, Icahn launched a

hostile takeover bid for Texaco Inc., an oil company. Icahn accused Texaco of

mismanagement and sought to replace the board of directors. The dispute ended

up in court, where Icahn eventually reached a settlement that led to

significant changes in Texaco's management structure.

TWA (Trans World Airlines) (1985-1993): Icahn acquired TWA in a highly leveraged

buyout in 1985. Over the years, he faced numerous legal challenges, including

clashes with labor unions and allegations of asset-stripping. In 1993, TWA

filed for bankruptcy, and Icahn stepped down as its chairman.

RJR Nabisco (1986): Icahn made an unsuccessful attempt to acquire RJR Nabisco, a

food and tobacco conglomerate. He accused the management of undervaluing the

company and engaging in unfair practices. The battle ended with the company

staying independent and Icahn selling his stake.

Lions Gate Entertainment (2015-2018): Icahn engaged in a legal battle with

Lions Gate Entertainment, a film and television production company. He claimed

that the company's acquisition of Starz, a premium cable network, was

detrimental to shareholders. The dispute resulted in Icahn reducing his stake

in the company and eventually settling the matter.

Herbalife (2012-2021): Icahn became involved in a highly publicized legal battle

surrounding Herbalife, a multi-level marketing company. Bill Ackman, a hedge

fund manager, accused Herbalife of being a pyramid scheme. Icahn, on the other

hand, vigorously defended the company and acquired a significant stake, leading

to an ongoing clash between the two investors. Icahn sold his stake in

Herbalife in 2021. He made a profit of $1 billion from the investment.

Conclusion:

Carl Icahn's life and career exemplify the remarkable journey

of a visionary investor, influential businessman, and dedicated philanthropist.

With his unique investment strategies, unwavering determination, and commitment

to making a positive impact, he has left an indelible mark on the business

world and beyond.

From his early beginnings on Wall Street to his notable

achievements as an activist investor, Icahn has consistently demonstrated his

ability to identify opportunities, challenge the status quo, and drive positive

change in the companies he invests in. His successful track record speaks

volumes about his expertise and business acumen.

Beyond his financial accomplishments, Icahn's philanthropy

has touched the lives of many. His generosity has supported education,

healthcare, and various other causes, creating lasting impacts and improving

the well-being of individuals and communities.

As we reflect on his life and achievements, we recognize Carl

Icahn as a true icon in the business world, leaving a legacy that continues to

inspire and shape the future of finance and philanthropy.

Some Unknown facts about Icahn’s

- He is a lifelong Mets fan and has owned a minority stake in the team since 1982.

- He is also a passionate art collector and owns a number of works by famous artists, including Pablo Picasso and Andy Warhol.

- Icahn is a member of the Giving Pledge, a commitment by some of the world's wealthiest people to donate the majority of their wealth to charitable causes.

- His first job was as a lifeguard at Jones Beach in New York.

- He has been involved in some high-profile corporate battles, including his unsuccessful attempt to take over RJR Nabisco in the 1980s.

- He is a vocal critic of corporate governance and has often used his position as a shareholder to push for changes in company policies.

- He is also a political activist and has donated money to both Democratic and Republican candidates.

Quotations:

- "In life and in business, you have to learn to temper your emotions."

- "I think making money is art, and working is art, and good business is the best art."

- "You learn in this business: If you want a friend, get a dog."

- "I get gratification from helping people. That's who I am."

- "You have to be very focused and very selective about what you do."

- "If you take risks and face your fate with dignity, there is nothing you can do that makes you small; if you don't take risks, there is nothing you can do that makes you grand, nothing."

- "I'm not against the establishment; I just happen to think it's corrupt."

- "The most important thing about motivation is goal-setting. You should always have a goal."

- "I like to think of myself as a benevolent dictator."

- "If you want to have a good outcome, you have to have a good process."

- "Money is very important, but it's not the most important thing in life."

- "I believe in doing the right thing, even if it doesn't work."

- "The consensus is always wrong."

- "I have respect for money. I have respect for what I do with money – what I've done with money."

- "I don't need the money, but I sure love it."

- "I look at things differently than most people do. I don't believe in conventional wisdom."

- "If you want to change a company, if you want to change an industry, you have to change it from within."

- "I've never really been a very social person. I'm really a loner."

- "If you're gonna be a good investor, you're gonna make some mistakes."

- "I don't go into a company to dismantle it. I go into a company to make it better."