“Markets are never wrong – opinions

often are.”

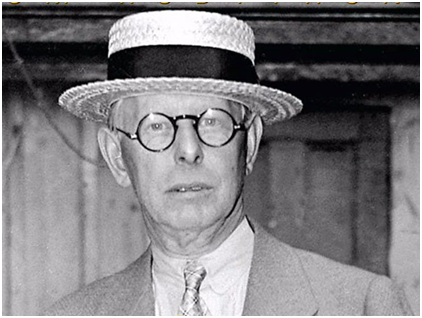

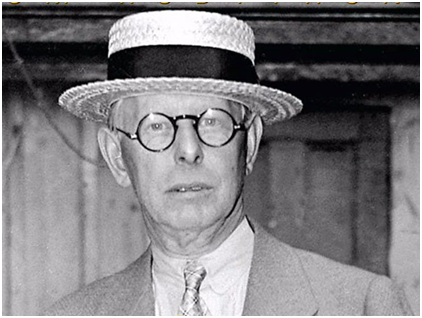

Jesse Livermore can be identified as

one of the famous traders of all time. He was born in 1877 in Shrewsbury, Massachusetts, United States, and died in

1940, Manhattan, New York, United States. Livermore was from a

very poor family, and he had to move to the town of Acton, Massachusetts, when

he was very young. At the age of three and a half, he was able to read and

write. He had to quit the school at the age of 14, as his father put asked him

to work on the farm, but he was able to escape from the house with the help of

his mother.

He started his first

job by posting stock quotes in Boston. He was given a wage of $ 5 per week. The

success of Jesse is remarkable, as he used his strategy and his funds. He did

not use the capital of the others in the process of trading. It is not

practicable to compare the modern market with the previous market, which Jesse

used to trade. Those days the markets were thinly traded and the moves were

volatile. There are several unique

patterns in the trading pattern of Jesse. He married three times and he

committed suicide due to the decline of his assets and the inability to face

the challenges of the career. In his life, he has faced bankruptcy three times.

He is one of the legendary figures of Wall Street.

Edwin Lefèvre, was an

American journalist, writer, and diplomat. He is most noted for his writings on

Wall Street business. He wrote a book on Jessie in 1923. It was named as Reminiscences of a Stock Operator. The

book recommended as one of the texts that every trader must read before

starting their career. In 1940 he wrote the bookHow to Trade in Stocks: The Livermore Formula for Combining Time

Element and Price. He was at his peak in 1923, and at that time he had a

wealth which is about $ 100 million, which equates to $ 1.5- 13 billion.

The method of trading of Jesse Livermore:

Jesse started and flourished before World War 1. In

that period, science and technology have not developed as today we can witness.

Modern traders have so many tools and applications that can help to make his

decision easier. Jesse had nothing but he was able to predict the way of the

market. Jesse has paid his attention to twoelements in the process of trading.

There are two main factors

- The test of the time

- Price pattern

Both factors are still applicable to the process of trading.

The exact timing is very important, and every trader is aware of

that. Timing that is a little too early or a little too late cannot help the

trader to obtain the maximum profit of his investment. According to Jesse

Livermore, the investor has to wait for the exact moment, though how much he

feels that the time is ready for the move. The investor must have a plan which

predicts the exact time of his move, so he has to stick to the plan, rather

than carried away by the impulses. When the time is ready,the tradermust make his move

swiftly.

As one of the traders in the recent past, Jesse did not have the

opportunity to use the moderndaily-charts and graphs to predict the current

pattern of the prices. He had a ledger that he has used to take down the prices

of the shares at that time. Jesse prefers to trade the stocks which move in a

trend, and he did not like to trade the stocks which are from ranging markets. When

the price of financial instrument registers similar highs and lows in several

occasions, the market can be identified as ranging. When the respective price

hits the same support and the resistance three times, the market can be

considers as ranging. Jesse waited for the prices to reach their optimum point

and then he observes the behavior of the respective process further before sell

or buy. Although he did not trade ranges, he usually traded breakouts from the

ranging markets.

To determine the trade kept open Jersey applied a combination of

price patterns and the volume analysis, to judge whether he was in the correct position.

Jesse’s have employed the following features:

- The increased volume at the breakout point

- Whether the breakout prices move in the breakout direction.

- After the end of the usual reaction, again the volume increases towards the direction of the trend.

Jesse identified the deviations from these as the indicators of

warning. The necessary trading strategies were applied by considering the

situation.

Timing the market

All the traders are aware that, the exact timing is very

important. The minute change of the identification of the correct time is

disastrous for the decision of the trading. In other words, timing is a

critical factor in the finical markets. Price offers the best indication of

timing.

Trading

rules

These

are some simple trading rules. Some of them are nearly a hundred years old, and

Jesse’s have contributed to some of them.

- Follow the trend, buy when the market is bull, and sell when it becomes a bear market.

- Search for clear opportunities before trading.

- Employ the pivotal points intruding.

- Be patient when entering the market, one can earn big money with a little patience.

- Close the losing trades and select the profitable trades.

- If the profit is doubtful exit the trade.

- Select the leading stocks in each sector(strongest in the bull market and the weakest in the bear market).

- Select a limited number of stocks.

Jesse’s

strategy

He

was highly successful on many occasions, and he also lost on several occasions.

It is his good practice to admit the mistakes, at the very first moment. These

are 2 elements for his loss

- The trading rules were not properly followed

- The trading rules were not followed at all

Career

He was just 15 years old when he

started his career. He used to bet at bucket shops at that time. It is a place

where investors had the opportunity to take the leveraged bets on the

respective stock prices, but theycannotpurchase or sell stocks at the bucket

shops. It was 1892 and he bet $5 on Chicago, Burlington, and Quincy

Railroad and he was able to earn $ 3.12 as the profit. he was able to secure more and more

winnings at the bucket shops. When he was 16 years old he has decided to give

up his job and start his career as a full-time investor. His full-time trading

has becomea success, and he has given $ 1’000 to his mother, who refused to

take that money, as she considered it as gambling money. His regular winning strategy

became a trouble to the bucket shops, so they barred him from betting at their

places. JesseLivermore carried out his work in disguise, but soon he has

decided to go to Wall Street. He initiated his practice in Wall Street with his

savings which is about $ 10’000. The Ticket tape was a tool that was used by

the traders to take decisions, but it was not updated regularly. As a result of

thatJesse was lost. Then he decidedto go to St. Louis and bet at the bucket shops.

The year 1901 has brought success. He was 24 years old young man at thattime.

Byusing $ 10’000 he bought the stocks in the Northern Pacific Railway and he

was able to turn his money into $ 500’000. It was thechangingpoint of his life.

In 1906 he was on avacation in Florida

he took a massive short position in Union Pacific Railroad. he bought it just

one day before the San Francisco earthquake. The expected outcome of the trade

is $ 250’000, but he has to bear a loss of $40’000 as a result of incorrect

advice from one of his friends.He has advisedJesse not to close his positions,

as a result of that Jesse has to receive a profit with certain loss.

In 1906 he was on avacation in Florida

he took a massive short position in Union Pacific Railroad. he bought it just

one day before the San Francisco earthquake. The expected outcome of the trade

is $ 250’000, but he has to bear a loss of $40’000 as a result of incorrect

advice from one of his friends.He has advisedJesse not to close his positions,

as a result of that Jesse has to receive a profit with certain loss.

The

Panic of 1907 made him a more successful trader than the past, as he wasable to

receive $ 1 million in one day by making huge short positions. Inmeantime he

has become one of the rich characters in society, so he has decided to enjoy life.

He purchased a yacht at $ 200’000, a rail car, and a luxury apartment onthe

Upper Westside. He spent his time in exclusive clubs and with mistresses. Jessedecided

to buy cotton as a result of the instruction of Teddy Price. He purchased, but

his friend sold his stocks secretly. Jessy has to face bankruptcy but was able

to recover all his losses. He filed bankruptcy again in 1915.

JesseLivermore

is one of the predictive traders. After the world war1. He cornered the market

in cotton very carefully and secretly. His move was highly impacted the economy

and he was summoned to the White House by President Woodrow Wilson. Asa result

of thenJesse agreed to sell cotton at break even, it has diluted the risk of rising

the price of cotton During 1924-1925 he carried out market manipulation and

secured $ 10 by trading wheat and cotton.

Jesse

has to use another strategy in trading short positions in 1929. He employed

more than 100 stockbrokers to concealhis actions. He was down over $ 6 million

by the spring, The Wall Street crash of 1929 helped him to cover about $ 100

million. He was nicknamed as the "Great Bear of the Wall Street" by

newspapers. The public has accused him of the crash and Jessehas to hire armed guard,

as he was threatenedto life by unknown parties.

Eventually

the good time of the JesseLivermorebegun to decline. The main reason is the

decline of his mental health. There were several reasons for this. The first thing is based on his family life.

He was divorced for the second time in 1932, and his son was shot by his wife

in 1935. Though it was not fatal, it has brought a lot of agony to the trader.

The lawsuit of this formerRussian mistress has made things worse forhim.

The newly imposed policies of the U.S. Securities and Exchange

Commission in 1934 severely impacted his process of trading.

This impact has become the main reason for declining his gains. It is not

clear, but he was bankrupted for the third time in 1934. His assetswere about $

84’000 and he has to pay $ 2.5 million as debts. Chicago Board of Trade cancelled

his membership on March 7, 1934. He paid his tax bill of $ 800’000 in 1937. The

great trader did not give up. He started a financial advisory business in 1939.

He established it for selling technical analysis systems for the traders.

Personal life

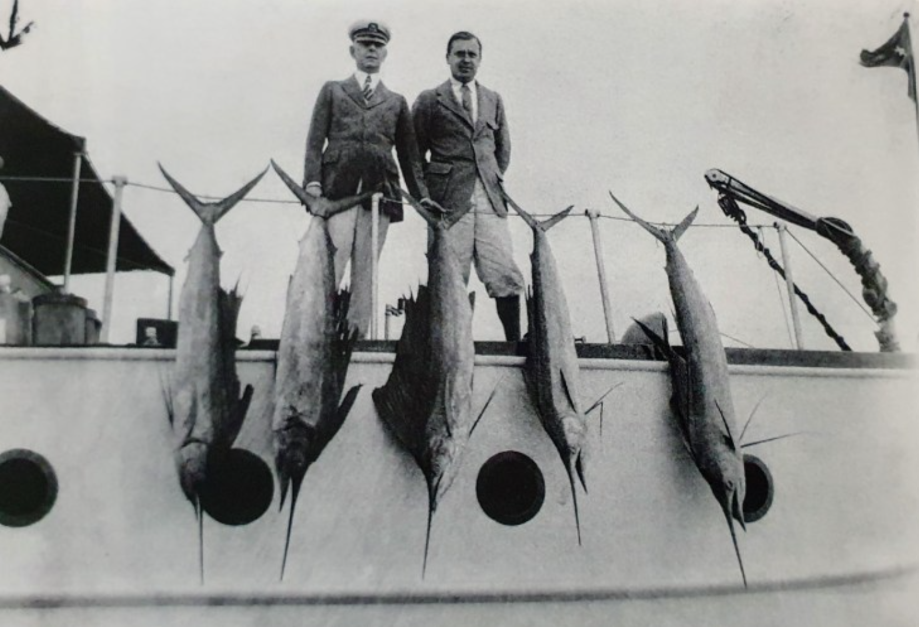

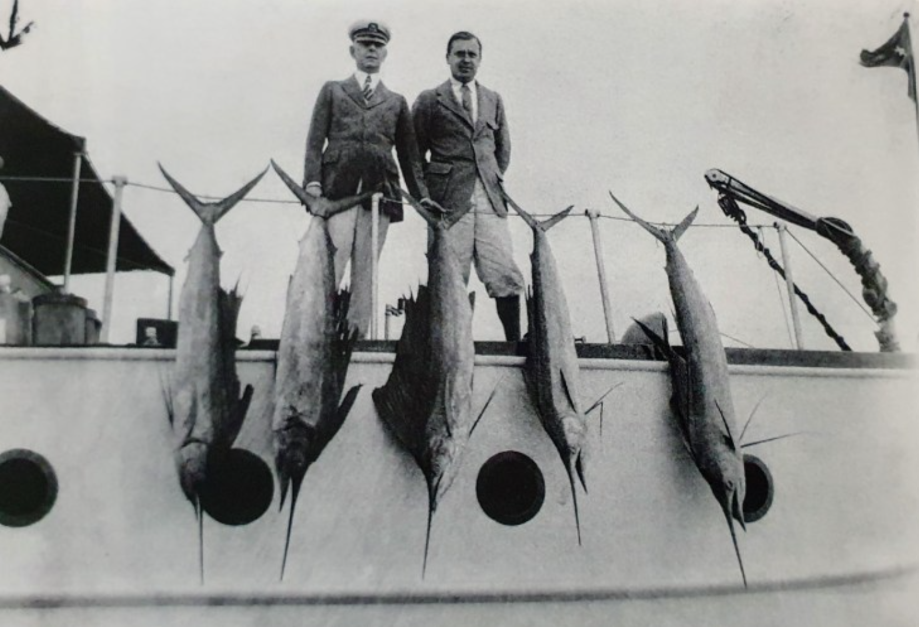

Jesse

Livermore was a good reader and his favorite book was Extraordinary Popular Delusions and the Madness of

Crowds by Charles Mackay. He was fond of outdooractivitiessuch

asyachting, fishing, etc. Once he was able to catch a swordfish which was more

than 436 pounds.

He

married three times but he had only two children. He married Netit Jordan in 1900, when he was 23 years old.

The marriage lasted less than a year. As a result of a personal dispute, they

had decided to separate and they divorced legally in 1917.

In

1918 he, married again. He was 40 years old and his bride was 22 years old

Dorothea Fox Wendt. They had two sons, and they are JesseLivermore Jr and Paul.

The elder was born in 1919 and the younger was in 1922. In 1931 Dorothy filed divorce

and they legally separated in 1932. She kept two sons in her custody and was

able to receive $ 10 million as a settlement. She sold the house at Great Neck

and it was torn down later. Jesse loved this house a lot and it made him more depressing.

The third marriage took place in 1933, and Jesse was 56 years old. This time he

married 38 years old singer. She was Harriet Metz Noble. She met Jesse on one

of these vacations. He was her fifth husband. ironically, two husbands of Metz

had committed suicide. One husband was Warren Noble, a trader.

End of the trader

It

is coincident that Jesse too had to suicide. He shot himself in one of his

favorite hotels on November 28 in 1940. The police found a suicidenote of this

great trader. It was an eight-paged text and he addressed it to his wife Harriet.

He has mentioned the reason for his act. It was frustration, asa result of

constant failures in the career. It is sad to mention that his son JesseLivermore

Jr committedsuicide in 1975 and his grandson also committedsuicide.

Quotations of Jesse

Livermore

- There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

- Buy rising stocks and sell falling stocks”

- Do not trade every day of every year.”

- Trade only when the market is clearly bullish or bearish”

- Only enter a trade after the action of the market confirms your opinion and then enter promptly”

- Continue with trades that show you a profit, end trades that show a loss”

- End trades when it is clear that the trend you are profiting from is over”

- In any sector, trade the leading stock – the one showing the strongest trend”

- Never average losses by, for example, buying more of a stock that has fallen”

- Go long when stocks reach a new high. Sell short when they reach a new low”

- Don’t become an involuntary investor by holding onto stocks whose price has fallen”

- Markets are never wrong – opinions often are”

- The highest profits are made in trades that show a profit right from the start”

- No trading rules will deliver a profit 100 percent of the time”

- As long as a stock is acting right, and the market is right, do not be in a hurry to take profits”

- Never buy a stock because it has had a big decline from its previous high”

- Never sell a stock because it seems high-priced”

- The human side of every person is the greatest enemy of the average investor or speculator”

- Wishful thinking must be banished”

- Big movements take time to develop”

- It is not good to be too curious about all the reasons behind price movements”

- It is much easier to watch a few than many”

- Patterns repeat, because human nature hasn’t changed for thousands of years”

- Don’t trust your own opinion and back your judgment until the action of the market itself confirms your opinion.

- Markets are never wrong – opinions often are.

- The real money made in speculating has been in commitments showing in profit right from the start.

- As long as a stock is acting right, and the market is right, do not be in a hurry to take profits.

- One should never permit speculative ventures to run into investments.

- The money lost by speculation alone is small compared with the gigantic sums lost by so-called investors who have let their investments ride.

- Never buy a stock because it has had a big decline from its previous high.

- Never sell a stock because it seems high-priced.

- I become a buyer as soon as a stock makes a new high on its movement after having had a normal reaction.

- Never average losses.

- The human side of every person is the greatest enemy of the average investor or speculator.