“When it comes to money, the best investments were probably

the ones I did not make.”

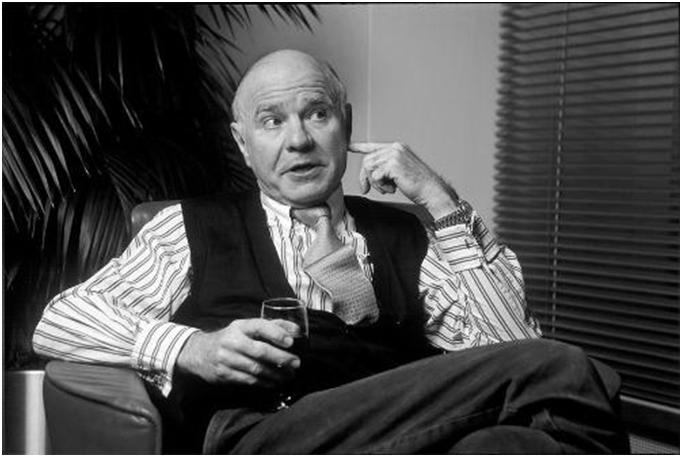

Marc Faber is a highly respected swiss economist,

investor, and writer, renowned for his contrarian views and insightful analysis

of global markets. With a wealth of experience and a keen eye for identifying

investment opportunities, Faber has captivated audiences worldwide. His

thought-provoking books, including "Tomorrow's Gold: Asia's Age of

Discovery" and "The Great Money Illusion: The Confusion of the

Confusions," have garnered critical acclaim. Faber's ability to challenge

prevailing market sentiments and offer alternative perspectives has earned him

a dedicated following among investors and traders. As a captivating speaker and

traveler, he brings a unique blend of expertise and firsthand insights into his

work. With his unwavering dedication to his craft, Marc Faber continues to

shape and influence the financial industry.

Marc Faber is a highly respected swiss economist,

investor, and writer, renowned for his contrarian views and insightful analysis

of global markets. With a wealth of experience and a keen eye for identifying

investment opportunities, Faber has captivated audiences worldwide. His

thought-provoking books, including "Tomorrow's Gold: Asia's Age of

Discovery" and "The Great Money Illusion: The Confusion of the

Confusions," have garnered critical acclaim. Faber's ability to challenge

prevailing market sentiments and offer alternative perspectives has earned him

a dedicated following among investors and traders. As a captivating speaker and

traveler, he brings a unique blend of expertise and firsthand insights into his

work. With his unwavering dedication to his craft, Marc Faber continues to

shape and influence the financial industry.

In the following sections, we will delve into the captivating

life and notable achievements of Marc Faber.

Early Life and Education:

Marc Faber was born in Zurich, Switzerland, on February 28,

1946. He was the only child of a banker father and a homemaker mother. Faber

attended school in Geneva and Zurich, and he graduated from high school with

the Matura, the Swiss equivalent of the A-level.

Faber was a gifted student, and he excelled in mathematics

and economics. He was also a talented athlete, and he was a member of the Swiss

National Ski Team (B-Team). After graduating from high school, Faber enrolled

at the University of Zurich, where he studied economics. He earned a PhD in

economics magna cum laude in 1970.

During his time at the University of Zurich, Faber worked as

a research assistant for the Swiss National Bank. He also wrote a thesis on the

economics of the Swiss National Ski Team. After graduating from university,

Faber worked for White Weld & Co. in New York City, Zurich, and Hong Kong.

In 1978, he joined Drexel Burnham Lambert Hong Kong, where he became a managing

director. In 1990, he set up his own investment advisory firm, Marc Faber Ltd.

Faber is a controversial figure in the financial world. He

has been criticized for his outspoken views and controversial predictions.

However, he is also respected for his insights into the global economy and his

ability to identify investment trends.

Professional Journey:

Marc Faber began his professional career in 1970, when he

joined White Weld & Co. in New York City. He worked for White Weld for two

years, before moving to Zurich to work for the Swiss National Bank.

In 1973, Faber moved to Hong Kong to work for Drexel Burnham

Lambert. He worked for Drexel Burnham Lambert for five years, before setting up

his own investment advisory firm, Marc Faber Ltd., in 1990.Faber has been the

publisher of the Gloom Boom & Doom Report newsletter since 1986. The Gloom

Boom & Doom Report is a monthly newsletter that provides investment advice

and analysis.

In addition to his work in the financial world, Faber is also

a writer and a publisher. He is a frequent guest on financial television shows

and podcasts. He is a regular contributor to financial publications such as The

Financial Times and The Economist. Faber is also the author of several books,

including:

- Tomorrow's Gold: Asia's Age of Discovery

- The Great Money Illusion: The Confusion of the Confusions

- The Dragon's Tail: How China Will Set the Course for the 21st Century

- The New Chinese Gold Rush: How to Profit from the Coming Boom in China

Faber is a fluent speaker of German, English, French, and

Italian. He is also a member of the Mont Pelerin Society, a think tank that

promotes classical liberal ideas. Faber is a contrarian investor, which means

that he often goes against the crowd. He believes that markets are often

irrational and that investors can profit by going against the herd. He is also

a strong advocate of investing in commodities and emerging markets.

Philosophy and Approach:

Marc Faber is a contrarian investor, which means that he

often goes against the crowd. He believes that markets are often irrational and

that investors can profit by going against the herd. He is also a strong

advocate of investing in commodities and emerging markets.

Faber's investment philosophy is based on the following

principles:

Be a contrarian. Don't follow the crowd. Instead, look for opportunities

where the market is wrong. This is a key principle of Faber's investment

philosophy. He believes that the market is often wrong and that investors can

profit by going against the herd.

Invest in commodities. Commodities are the only assets that have intrinsic value.

They are not subject to the same kind of manipulation as stocks or bonds.

Commodities are physical assets that have a real-world use. They are not

subject to the same kind of manipulation as stocks or bonds, which can be

artificially inflated or deflated by market forces.

Invest in emerging markets. Emerging markets are the future of the world economy.

They offer great growth potential and are less expensive than developed

markets. Emerging markets are countries that are still developing their

economies. They offer great growth potential, as they are still catching up to

developed countries. They are also less expensive than developed markets, as they

are not as well-known or as liquid.

Diversify your portfolio. Don't put all your eggs in one basket. Spread your

risk by investing in a variety of assets. This is a classic investment

principle that is often overlooked. By diversifying your portfolio, you reduce

the risk of losing all your money if one asset class performs poorly.

Be patient. Investing is a long-term game. Don't expect to get rich

quickly. This is another important principle of Faber's investment philosophy.

He believes that investors should be patient and focus on the long term. The

stock market is volatile, and there will be ups and downs. However, if you are

patient and stay invested, you are more likely to see your investment grow over

time.

Faber's approach to investing has been successful over the

years. He has been credited with predicting several major market crashes,

including the 1987 stock market crash and the 2008 financial crisis. He is also

a respected figure in the financial world, and his newsletter is read by

investors around the world.

Marc Faber’s Philanthropic Work:

Marc Faber is a philanthropist who is committed to helping

others. He has donated money to a variety of charities, including:

Child's Dream is a charity that helps underprivileged children in the

Mekong Sub-region. Child's Dream provides education, healthcare, and other

essential services to children in need.

Smile Asia is a charity that provides free cleft lip and palate surgery

to children in Asia. Cleft lip and palate are birth defects that can cause

serious health problems. Smile Asia provides surgery to children who would not

otherwise be able to afford it.

The Mont Pelerin Society is a think tank that promotes

classical liberal ideas. The Mont Pelerin Society is a forum for economists and

other thinkers to discuss free market economics and individual liberty.

Faber is also a founding member of the Faber Family Foundation,

which provides financial support to a variety of charitable causes. The Faber

Family Foundation has donated money to build schools and libraries in

developing countries, support environmental causes, and help people in need

during natural disasters.

Faber's philanthropic work is motivated by his belief that

everyone has a responsibility to help others. He believes that we should all do

our part to make the world a better place.

Personal life:

Marc Faber was born in Zurich, Switzerland. He was the only

child of a banker father and a homemaker mother. Faber's father was a Swiss

national, and his mother was a German national. Faber's wife, Supatra, is a

Thai national. She is a graduate of the University of Bangkok and works as a

financial consultant in Phuket.

Faber's daughter, Nantamada, is a graduate of the London

School of Economics and works as a financial analyst in London. Faber is a keen

skier and golfer. He enjoys spending time in the mountains and on the golf

course. Faber is also a voracious reader. He enjoys reading books on economics,

history, and politics.

Marc FaberControversies:

Marc Faber is a polarizing figure in the financial world. His

outspoken views and controversial predictions have earned him both praise and

criticism.Some of the controversies that have surrounded Faber include:

In 2006, Faber predicted that the

Chinese stock market would crash. This prediction was not well-received by the

Chinese government, and Faber was banned from entering China for several years.

Faber's prediction that the Chinese stock market would crash

was based on his belief that the Chinese economy was overvalued. He argued that

the Chinese government was artificially inflating the stock market, and that

this would eventually lead to a crash.

Faber's prediction turned out to be correct. The Chinese

stock market crashed in 2007, and Faber was vindicated. However, his prediction

also led to a backlash against him. The Chinese government was not happy that

Faber had criticized the Chinese economy, and they banned him from entering

China.

In 2008, Faber predicted that the

global financial crisis would be worse than the Great Depression. This

prediction was also controversial, but it turned out to be accurate.

Faber's prediction that the global financial crisis would be

worse than the Great Depression was based on his belief that the financial

system was fundamentally flawed. He argued that the financial system was too

complex and too interconnected, and that this would make it difficult to

contain the crisis.

In 2017, Faber made a racist remark

about the United States. He said that the United States would "look like

Zimbabwe" if it were settled by black people. This remark was widely

condemned, and Faber was forced to apologize.

Faber's racist remark was made in an interview with the

Financial Times. He was asked about the future of the United States, and he

responded by saying that the United States would "look like Zimbabwe"

if it were settled by black people.

Faber's remark was widely condemned by people around the

world. The Financial Times apologized for publishing the remark, and Faber was

forced to apologize. However, Faber's remark damaged his reputation, and he is

still seen as a controversial figure in the financial world.

Conclusion:

In conclusion, the life and achievements of Marc Faber have

made an indelible mark on the finance world. With his contrarian views,

insightful analysis, and ability to anticipate market trends, he has garnered

widespread recognition and respect. Through his influential books, captivating

presentations, and extensive travels, Faber has shared invaluable insights into

global markets and economies. His unwavering dedication to his craft, coupled

with a deep understanding of economic principles, has allowed him to navigate the

ever-changing financial landscape with precision.

Marc Faber's willingness to challenge conventional wisdom and

his knack for identifying investment opportunities where others may overlook

them have solidified his position as a respected authority. His contrarian

perspectives have guided and inspired investors, helping them navigate

turbulent markets and seize opportunities.

As a renowned economist, investor, and writer, Faber's

contributions continue to shape the finance industry. His unique perspectives

and expertise have left an enduring legacy, influencing how investors approach

the markets and think about global economic trends. By sharing his knowledge

and experiences, Marc Faber has made a lasting impact on the field of finance,

leaving a trail of insight and inspiration for future generations.

Some Unknown facts about Faber:

Here are some unknown facts about Marc Faber:

- Faber is a keen skier and golfer. He enjoys spending time in the mountains and on the golf course.

- Faber is also a voracious reader. He enjoys reading books on economics, history, and politics.

- Faber is a fluent speaker of German, English, French, and Italian.

- Faber is a member of the Mont Pelerin Society, a think tank that promotes classical liberal ideas.

- Faber is a critic of central banks and government intervention in the economy.

- Faber is a proponent of gold as a hedge against inflation and currency devaluation.

- Faber is a frequent critic of the financial media, which he believes is often biased and inaccurate.

- Faber is a controversial figure in the financial world. He has been criticized for his outspoken views and his controversial predictions.

- Faber's racist remark in 2017 was particularly controversial. He was forced to apologize for the remark, but it damaged his reputation.

Quotations:

- Every central banker in the world pays attention to credit growth, but not in the U.S.

- I am pretty sure central banks will continue to print money, and the standards of living for people in the western world, not just in America, will continue to decline because the cost of living increases will exceed income. The cost of living will also go up because all kinds of taxes will increase.

- I am surprised with the reelection of Mr. Obama. The S&P is only down, like, 30 points. I would have thought that the market on his reelection should be down at least 50%.

- I believe that the market is slowly waking up to the fact that the Federal Reserve is a clueless organization. They have no idea what they're doing. And so, the confidence level of investors is diminishing, in my view.

- I do know some of the world's richest people. In monetary terms, they all performed very well. In terms of a fulfilling life, I am less sure.

- I don't particularly like equities, but I think equities are a better space to be in than bonds.

- I don't think Canada is very inexpensive anymore. I travel there all the time; it's rather on the expensive side. I thinkthere'ssignificantrisk to the Canadian economy.

- I think Mr. Obama is a disaster for business and a disaster for the United States. Not that Mr. Romney would be much better, but the Republicans understand the problem of excessive debt better than Mr. Obama, who basically doesn't care about piling up debt.

- I would rather buy Indian equities than the S&P 500.

- I'd rather buy something that is relatively depressing than something that is relatively high.

- If the Chinese bubble bursts one day, which inevitably will happen - maybe not tomorrow, maybe in three months, maybe in three years - when it happens, it will have devastating consequences for the global economy.

- If we have an economic crisis in the Western world, it's because the government makes up 50 percent or more of the economy. This iscancerthatistaking away people's freedom.

- If you print money like in Zimbabwe... the purchasing power of money goes down, and the standards of living go down, and eventually, you have a civil war.

- If you really believe that every three years the market will double, then go and buy shares. I don'tbelievethat.

- If you're in any field, you should own a farm because one day you will be grateful that you are able to grow your own agricultural produce.

- I'm an economist. I'm not a political servant.

- Market forces will one day crush the Federal Reserve. One day, the market forces will reverse.

- My worst investment decision so far is to lend money to friends. So far, ithas all come to zero.

- Over my career, somewhere, somehow, I must've made some right calls. Otherwise, I wouldn'tbe in business.

- The best way to deal with any economic problem is to let the market work it through.

- The positive aspect of my negative view is essentially that you shouldn't own cash and government bonds, but you should be in assets like real estate or equities or precious metals or in commodities.

- What I object to is the current government intervention in so-called 'solving the crisis', they haven't solved anything. They've just postponed it.

- When everyone thinks alike, no one is thinking clearly.

- When it comes to charities, there's a lot of fraud.

- When it comes to money, the best investments were probably the ones I did not make.

- When you have a perfect free market, it's difficult to predict the future. But when you have a market that is disturbed by government manipulations and money-printing, it's impossible to make any predictions.