Dow Jones Industrial Average

34,823.35

25 (0.07%)

Nasdaq 100

14,940.17

98 (0.66%)

S&P 500

7,993.12

0 (0.00%)

US Dollar/Euro FX Cross Rate

0.85

0 (0.01%)

US Dollar/Euro FX Cross Rate

0.85

0 (0.01%)

Silver

25.18

0 (-0.25%)

Gold (COMEX)

1,793.80

-4 (-0.22%)

NASDAQ Composite

14,684.60

53 (0.36%)

EUR/USD

1.18

0 (-0.03%)

Copper

4.36

0 (0.35%)

US Dollar/Japanese Yen FX Spot Rate

110.53

0 (0.34%)

Bitcoin

32,329.56

-56 (-0.17%)

US Dollar/UK Pound Sterling FX Cross Rate

0.73

0 (0.22%)

USD/CHF

0.92

0 (0.24%)

Swiss Franc/US Dollar FX Cross Rate

1.09

0 (-0.22%)

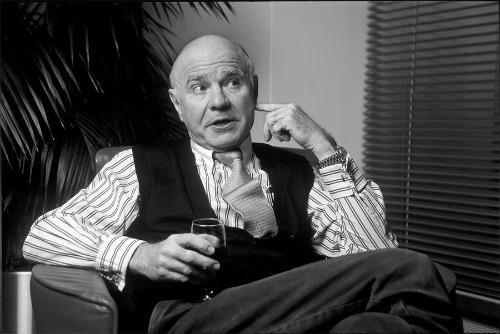

Marc Faber

Stock Expert, Dr. Doom

"When it comes to money, the best investments were probably the ones I did not make." - Marc Faber

Marc Faber is a highly respected economist, investor, and writer, renowned for his contrarian views and insightful analysis of global markets. With a wealth of experience and a keen eye for identifying investment opportunities, Faber has captivated audiences worldwide. His thought-provoking books, including "Tomorrow's Gold: Asia's Age of Discovery" and "The Great Money Illusion: The Confusion of the Confusions," have garnered critical acclaim. Faber's ability to challenge prevailing market sentiments and  offer alternative perspectives has earned him a dedicated following among investors and traders. As a captivating speaker and traveler, he brings a unique blend of expertise and firsthand insights into his work. With his unwavering dedication to his craft, Marc Faber continues to shape and influence the financial industry.

offer alternative perspectives has earned him a dedicated following among investors and traders. As a captivating speaker and traveler, he brings a unique blend of expertise and firsthand insights into his work. With his unwavering dedication to his craft, Marc Faber continues to shape and influence the financial industry.

In the following sections, we will delve into the captivating life and notable achievements of Marc Faber.

Early Life and Education:

Marc Faber was born in Zurich, Switzerland, on February 28, 1946. Marc Faber was born in Zurich, Switzerland, on February 28, 1946. He was the only child of a banker father and a homemaker mother. Faber attended school in Geneva and Zurich, and he graduated from high school with the Matura, the Swiss equivalent of the A-level.

Faber was a gifted student, and he excelled in mathematics and economics. He was also a talented athlete, and he was a member of the Swiss National Ski Team (B-Team). After graduating from high school, Faber enrolled at the University of Zurich, where he studied economics. He earned a PhD in economics magna cum laude in 1970.

During his time at the University of Zurich, Faber worked as a research assistant for the Swiss National Bank. He also wrote a thesis on the economics of the Swiss National Ski Team. After graduating from university, Faber worked for White Weld & Co. in New York City, Zurich, and Hong Kong. In 1978, he joined Drexel Burnham Lambert Hong Kong, where he became a managing director. In 1990, he set up his own investment advisory firm, Marc Faber Ltd.

Faber is a controversial figure in the financial world. He has been criticized for his outspoken views and controversial predictions. However, he is also respected for his insights into the global economy and his ability to identify investment trends.

Professional Journey:

Marc Faber began his professional career in 1970, when he joined White Weld & Co. in New York City. He worked for White Weld for two years, before moving to Zurich to work for the Swiss National Bank.

In 1973, Faber moved to Hong Kong to work for Drexel Burnham Lambert. He worked for Drexel Burnham Lambert for five years, before setting up his own investment advisory firm, Marc Faber Ltd., in 1990. Faber has been the publisher of the Gloom Boom & Doom Report newsletter since 1986. The Gloom Boom & Doom Report is a monthly newsletter that provides investment advice and analysis.

In addition to his work in the financial world, Faber is also a writer and a publisher. He is a frequent guest on financial television shows and podcasts. He is a regular contributor to financial publications such as The Financial Times and The Economist. Faber is also the author of several books, including:

⦁ Tomorrow's Gold: Asia's Age of Discovery

⦁ The Great Money Illusion: The Confusion of the Confusions

⦁ The Dragon's Tail: How China Will Set the Course for the 21st Century

⦁ The New Chinese Gold Rush: How to Profit From the Coming Boom in China

Faber is a fluent speaker of German, English, French, and Italian. He is also a member of the Mont Pelerin Society, a think tank that promotes classical liberal ideas. Faber is a contrarian investor, which means that he often goes against the crowd. He believes that markets are often irrational and that investors can profit by going against the herd. He is also a strong advocate of investing in commodities and emerging markets.

Philosophy and Approach:

Marc Faber is a contrarian investor, which means that he often goes against the crowd. He believes that markets are often irrational and that investors can profit by going against the herd. He is also a strong advocate of investing in commodities and emerging markets.

Faber's investment philosophy is based on the following principles:

Be a contrarian. Don't follow the crowd. Instead, look for opportunities where the market is wrong. This is a key principle of Faber's investment philosophy. He believes that the market is often wrong and that investors can profit by going against the herd.

Invest in commodities. Commodities are the only assets that have intrinsic value. They are not subject to the same kind of manipulation as stocks or bonds. Commodities are physical assets that have a real-world use. They are not subject to the same kind of manipulation as stocks or bonds, which can be artificially inflated or deflated by market forces.

Invest in emerging markets. Emerging markets are the future of the world economy. They offer great growth potential and are less expensive than developed markets. Emerging markets are countries that are still developing their economies. They offer great growth potential, as they are still catching up to developed countries. They are also less expensive than developed markets, as they are not as well-known or as liquid.

Diversify your portfolio. Don't put all your eggs in one basket. Spread your risk by investing in a variety of assets. This is a classic investment principle that is often overlooked. By diversifying your portfolio, you reduce the risk of losing all your money if one asset class performs poorly.

Be patient. Investing is a long-term game. Don't expect to get rich quickly. This is another important principle of Faber's investment philosophy. He believes that investors should be patient and focus on the long term. The stock market is volatile, and there will be ups and downs. However, if you are patient and stay invested, you are more likely to see your investment grow over time.

Faber's approach to investing has been successful over the years. He has been credited with predicting several major market crashes, including the 1987 stock market crash and the 2008 financial crisis. He is also a respected figure in the financial world, and his newsletter is read by investors around the world.

Marc Faber’s Philanthropic Work:

Marc Faber is a philanthropist who is committed to helping others. He has donated money to a variety of charities, including:

Child's Dream is a charity that helps underprivileged children in the Mekong Sub-region. Child's Dream provides education, healthcare, and other essential services to children in need.

Smile Asia is a charity that provides free cleft lip and palate surgery to children in Asia. Cleft lip and palate are birth defects that can cause serious health problems. Smile Asia provides surgery to children who would not otherwise be able to afford it.

The Mont Pelerin Society is a think tank that promotes classical liberal ideas. The Mont Pelerin Society is a forum for economists and other thinkers to discuss free market economics and individual liberty.

Faber is also a founding member of the Faber Family Foundation, which provides financial support to a variety of charitable causes. The Faber Family Foundation has donated money to build schools and libraries in developing countries, support environmental causes, and help people in need during natural disasters.

Faber's philanthropic work is motivated by his belief that everyone has a responsibility to help others. He believes that we should all do our part to make the world a better place.

Personal life:

Marc Faber was born in Zurich, Switzerland. He was the only child of a banker father and a homemaker mother. Faber's father was a Swiss national, and his mother was a German national. Faber's wife, Supatra, is a Thai national. She is a graduate of the University of Bangkok and works as a financial consultant in Phuket.

Faber's daughter, Nantamada, is a graduate of the London School of Economics and works as a financial analyst in London. Faber is a keen skier and golfer. He enjoys spending time in the mountains and on the golf course. Faber is also a voracious reader. He enjoys reading books on economics, history, and politics.

Marc Faber Controversies:

Marc Faber is a polarizing figure in the financial world. His outspoken views and controversial predictions have earned him both praise and criticism. Some of the controversies that have surrounded Faber include:

In 2006, Faber predicted that the Chinese stock market would crash. This prediction was not

well-received by the Chinese government, and Faber was banned from entering China for

several years.

Faber's prediction that the Chinese stock market would crash was based on his belief that the Chinese economy was overvalued. He argued that the Chinese government was artificially inflating the stock market, and that this would eventually lead to a crash.

Faber's prediction turned out to be correct. The Chinese stock market crashed in 2007, and Faber was vindicated. However, his prediction also led to a backlash against him. The Chinese government was not happy that Faber had criticized the Chinese economy, and they banned him from entering China.

In 2008, Faber predicted that the global financial crisis would be worse than the Great

Depression. This prediction was also controversial, but it turned out to be accurate.

Faber's prediction that the global financial crisis would be worse than the Great Depression was based on his belief that the financial system was fundamentally flawed. He argued that the financial system was too complex and too interconnected, and that this would make it difficult to contain the crisis.

In 2017, Faber made a racist remark about the United States. He said that the United States

would "look like Zimbabwe" if it were settled by black people. This remark was widely

condemned, and Faber was forced to apologize.

Faber's racist remark was made in an interview with the Financial Times. He was asked about the future of the United States, and he responded by saying that the United States would "look like Zimbabwe" if it were settled by black people.

Faber's remark was widely condemned by people around the world. The Financial Times apologized for publishing the remark, and Faber was forced to apologize. However, Faber's remark damaged his reputation, and he is still seen as a controversial figure in the financial world.

Conclusion:

In conclusion, the life and achievements of Marc Faber have made an indelible mark on the finance world. With his contrarian views, insightful analysis, and ability to anticipate market trends, he has garnered widespread recognition and respect. Through his influential books, captivating presentations, and extensive travels, Faber has shared invaluable insights into global markets and economies. His unwavering dedication to his craft, coupled with a deep understanding of economic principles, has allowed him to navigate the ever-changing financial landscape with precision.

Marc Faber's willingness to challenge conventional wisdom and his knack for identifying investment opportunities where others may overlook them have solidified his position as a respected authority. His contrarian perspectives have guided and inspired investors, helping them navigate turbulent markets and seize opportunities.

As a renowned economist, investor, and writer, Faber's contributions continue to shape the finance industry. His unique perspectives and expertise have left an enduring legacy, influencing how investors approach the markets and think about global economic trends. By sharing his knowledge and experiences, Marc Faber has made a lasting impact on the field of finance, leaving a trail of insight and inspiration for future generations.

Some Unknown facts about Faber:

Here are some unknown facts about Marc Faber:

⦁ Faber is a keen skier and golfer. He enjoys spending time in the mountains and on the golf course.

⦁ Faber is also a voracious reader. He enjoys reading books on economics, history, and politics.

⦁ Faber is a fluent speaker of German, English, French, and Italian.

⦁ Faber is a member of the Mont Pelerin Society, a think tank that promotes classical liberal ideas.

⦁ Faber is a critic of central banks and government intervention in the economy.

⦁ Faber is a proponent of gold as a hedge against inflation and currency devaluation.

⦁ Faber is a frequent critic of the financial media, which he believes is often biased and inaccurate.

⦁ Faber is a controversial figure in the financial world. He has been criticized for his outspoken views and

his controversial predictions.

⦁ Faber's racist remark in 2017 was particularly controversial. He was forced to apologize for the remark,

but it damaged his reputation.

Quotations:

⦁ Every central banker in the world pays attention to credit growth, but not in the U.S.

⦁ I am pretty sure central banks will continue to print money, and the standards of living for people in the

western world, not just in America, will continue to decline because the cost of living increases will

exceed income. The cost of living will also go up because all kinds of taxes will increase.

⦁ I am surprised with the reelection of Mr. Obama. The S&P is only down, like, 30 points. I would have

thought that the market on his reelection should be down at least 50%.

⦁ I believe that the market is slowly waking up to the fact that the Federal Reserve is a clueless

organization. They have no idea what they're doing. And so, the confidence level of investors is

diminishing, in my view.

⦁ I do know some of the world's richest people. In monetary terms, they all performed very well. In terms

of a fulfilling life, I am less sure.

⦁ I don't particularly like equities, but I think equities are a better space to be in than bonds.

⦁ I don't think Canada is very inexpensive anymore. I travel there all the time; it's rather on the expensive

side. I think there's significant risk to the Canadian economy.

⦁ I think Mr. Obama is a disaster for business and a disaster for the United States. Not that Mr. Romney

would be much better, but the Republicans understand the problem of excessive debt better than Mr.

Obama, who basically doesn't care about piling up debt.

⦁ I would rather buy Indian equities than the S&P 500.

⦁ I'd rather buy something that is relatively depressing than something that is relatively high.

⦁ If the Chinese bubble bursts one day, which inevitably will happen - maybe not tomorrow, maybe in

three months, maybe in three years - when it happens, it will have devastating consequences for the

global economy.

⦁ If we have an economic crisis in the Western world, it's because the government makes up 50 percent or

more of the economy. This is cancer that is taking away people's freedom.

⦁ If you print money like in Zimbabwe... the purchasing power of money goes down, and the standards of

living go down, and eventually, you have a civil war.

⦁ If you really believe that every three years the market will double, then go and buy shares. I don't

believe that.

⦁ If you're in any field, you should own a farm because one day you will be grateful that you are able to

grow your own agricultural produce.

⦁ I'm an economist. I'm not a political servant.

⦁ Market forces will one day crush the Federal Reserve. One day, the market forces will reverse.

⦁ My worst investment decision so far is to lend money to friends. So far, it has all come to zero.

⦁ Over my career, somewhere, somehow, I must've made some right calls. Otherwise, I wouldn't be in

business.

⦁ The best way to deal with any economic problem is to let the market work it through.

⦁ The positive aspect of my negative view is essentially that you shouldn't own cash and government

bonds, but you should be in assets like real estate or equities or precious metals or in commodities.

⦁ What I object to is the current government intervention in so-called 'solving the crisis', they haven't

solved anything. They've just postponed it.

⦁ When everyone thinks alike, no one is thinking clearly.

⦁ When it comes to charities, there's a lot of fraud.

⦁ When it comes to money, the best investments were probably the ones I did not make.

⦁ When you have a perfect free market, it's difficult to predict the future. But when you have a market that

is disturbed by government manipulations and money-printing, it's impossible to make any predictions.